How to save $5000 More

Introducing the 52-week money challenge

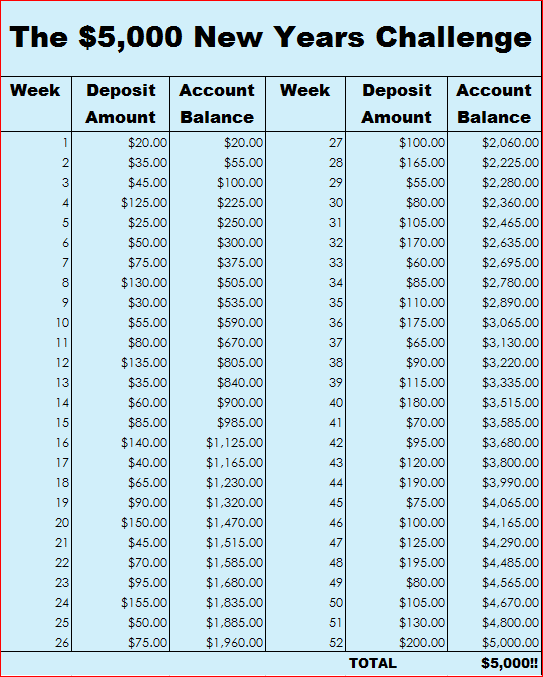

This chart below from Money Challenge/Pinterest introduces the idea of the “savings snowball.” You start by socking away $20 during the first week of January. Everybody can do that, right?

Then during the second week, you save $35. During the third week, this plan calls for you to save $45. And each week the amount you save gets progressively bigger.

It’s during the fourth week that things get tricky. You’re supposed to stash away $125 during the last week of January.

In fact, every fourth week for the rest of 2017, this plan calls for a quantum savings leap. You’ll need to come up with at or near $100+ more than what you saved the prior week.

That means one of two things — either you’ll be saving beaucoup bucks in no time flat, or your savings plan will fall flat on its face very early on.

Let’s see what we can do to help you avoid the latter scenario!

Here are a few ways to reduce your bills and create more money in your life

We want you to successfully complete the 52-week money challenge in 2017! Try these ideas and see if they can help you accomplish that goal.

Develop a zero-based budget for 2017

This kind of budget is all about preplanning. Each week when you get paid, you’ll already know exactly where every dollar is going. It’s a great way to seal up the kind of budget leaks that can derail financial success.

Use your pay schedule to eke out 2 extra paycheck’s worth of savings!

This ingenious trick works if you’re paid every two weeks, rather than twice a month.

Here’s how you can stash the paychecks that come during the two months of the year when you’ll get three paychecks instead of two!

Join a warehouse club and save big buying in bulk

Costco Wholesale, Sam’s Club and BJ’s Wholesale Club offer amazing deals on everything from soup to nuts and tires to socks!

Lower the price of your pay TV bill

New numbers for September 2016 from Leichtman Research Group, Inc. show that the average household pays $103.10/month for pay TV service. That’s $1,237.20 each year and it’s just the average; some people pay a lot more!

Thankfully, there are a lot of opportunities in the market to reduce that monthly bill and still get the great content you love.

Locate missing and unclaimed money in your name

Simply go to MissingMoney.com and punch in your name to do a database search of available unclaimed funds across all states. Please note that not every single state participates. If you live in a state that doesn’t participate with this free site, there’s one more option for you: Unclaimed.org. This website is a clearinghouse for the National Association of Unclaimed Property Administrators.

Finally, maybe a grandparent bought you a savings bond when you were born and it’s been lost over the years. Here’s how you can track down lost savings bonds and get your money!

Lower your student loan payment

Student loans are a burden for many people both young and old. Fortunately, there are ways to refinance your student loans, get on a better repayment plan or even possibly qualify for student loan forgiveness based on your choice of career! Just think about the money you could save…

Skip the extended warranty on electronics

When you’re buying your next gadget, you know you’ll get the pitch: Would you like to buy the extended warranty on that?

According to Consumer Reports, electronics seldom fail. In fact, TVs fail at only a 3% rate in the first four years of ownership. Why would anyone buy a warranty when you have a 97% that your TV will work for numerous years?

And here’s a little known tip: Many credit cards will double the manufacturer’s original warranty up to one additional year if you use them to make your purchase. That’s how you approximate getting an extended warranty for free!

Choose a cheaper cell plan

It seems like every week there’s a new price point being set in the telecommunications world. Did you know that’s it’s now entirely possible to get free phone service that will meet your needs if you’re a light volume data user? No worries if you need more data; you too can save a bundle by making the switch to a low-cost carrier and still get all the data you need!

Reduce your withholding

Do you get a tax refund every year? That means you’ve made an interest-free loan to the government and your money has been working for them — not you — all year long.

People try to justify their tax refunds by saying it’s a way to force themselves to save money. Truth is, there may be a better way to accomplish the goal: Let’s say you typically get a refund of $1,200 every year. Try reducing your withholding at work by $100 a month and have your bank or credit union automatically transfer that $100 each month into a savings account.

You never see the money, so you never miss it. But the end result is that you’ll build your savings and earn interest all year long. Use the IRS Withholding Calculator to avoid having too much or too little federal income tax withheld from your pay. Then talk to your HR department at work to put your plan in action.

Stop throwing money away on expensive razors

Every one has to shave, right? If razors take up too big a chunk of your budget, here’s a little secret that will save you big bucks: Razor blades degrade much faster when they’re left wet. If you either blot your razor dry on a towel after use or maybe use a hair dryer to dry it, you’ll radically extend the life of the blade.

Clark himself is famous for taking a 17-cent disposable razor that he uses everyday and making it last for 12 months by using the blotting method!

Raise the deductible on your insurance

The typical auto insurance customer can save up to $500 a year by bumping their deductible up from $250 to $500. That savings jumps on average to $1,000 annually if you make the leap to a $1,000 deductible.

By raising your deductible, you’ll pay less in premiums, but more importantly, you’ll reduce the risk that your insurer will cancel your coverage because you made too many claims. In particular, homeowners insurance can be used only in the case of a catastrophic loss. It’s a “use it and lose it” proposition.

One final word about car insurance. If you have an old car that’s of little value, it may be time to have liability only (not collision and comprehensive) on your policy if the cost of full coverage is greater than 10% annually of the car’s value. You can determine your vehicle’s value at KBB.com, NADA.com or Edmunds.com.

Stop paying for insurance you don’t need

You can get insurance on almost anything — computers, phones, trips, your identity, your credit and even home warranties! But should you?

Identity theft insurance, mortgage life and disability insurance and home wiring insurance just scratch the surface of policies that aren’t worth the price!

Check all of your monthly statements line-by-line

Too often, people just get bills of all kinds charged to their credit card and never see a statement. Don’t be one of them! Get hold of those monthly statements and scrutinize them line-by-line.

Cell phone bills can be almost impossible to understand, making phony cram charges a real possibility. Look for line items with deceptive terms such as “Premium Content” or “Direct Bill Charge” (sometimes referred to as “DBC” on your bill.) If it’s something you didn’t agree to, call up your provider and get your money back.

Get help paying for specialty medications

What do you do if you have an illness that requires special medicine and you can’t afford it despite having insurance? One pharmaceutical executive turned philanthropist has set up a charity called TheAssistanceFund.org to provide co-pay assistance that can make the difference between life and death for some patients.

This non-profit helps pay for some medications by footing a significant amount of the out-of-pocket for insured patients. Best of all, TheAssistanceFund.org tries to approve people for assistance within 24 hours because they know time is of the essence.

26Â ways to make more money!

1. Ask for a raise

A lot of people are afraid of asking for a raise at work, but when you think about it —Â worst case your boss says no, best case your boss says yes!

However, you need to have a strong argument when you decide to make your move. Do some prep work and have your talking points ready to go. Know the salary range for your position, the value you add to the company and specific examples of your accomplishments at work. Consider timing too — when you’ve been performing at the highest level is a good time to ask.

Here are a couple of resources that can help: